Finance

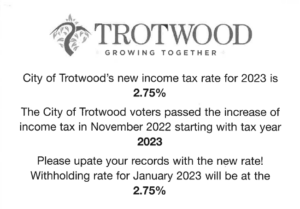

Income Tax

General Tax Information

Read general information on the Trotwood income tax.

Central Collection Agency

The City of Trotwood continues its efforts to collect income taxes owed to the city by some Trotwood taxpayers through the Central Collection Agency.

Income Tax Contact Information

Income Tax Ordinance

Tax Forms for Businesses

Tax Forms for Individuals

Tax Forms for Landlords

Tax Tool

Anyone can prepare their Trotwood City Income Tax Returns using the city's new online Tax Tool. Simply follow the instructions to create a new account. It provides users the ability to enter data and prepare the return from their computer.

The user's return can be printed, signed, and mailed with any attachments to:

City of Trotwood Income Tax Support Services

4 Strader Drive

Trotwood, OH 45426

Annual Reconciliation Form

-

Reconciliation Mailing Address

City of Trotwood Income Tax Support Services

4 Strader Drive

Trotwood, Ohio 45426

Withholding Tax Packages

Contact Us:

Sue Bowman

Income Tax Supervisor

Ph: 937-837-3415

Email: taxquestions@trotwood.orgGrace Stevens

Income Tax Clerk

Ph: 937-837-3415

Email: taxquestions@trotwood.orgTammara Liberty

Income Tax Analyst

Ph: 937-837-3415

Email: taxquestions@trotwood.org