Finance

General Tax Information

Sue Bowman

Income Tax Supervisor

Ph: 937-837-3415

Email: taxquestions@trotwood.orgHours

Monday - Friday

9:30 a.m. - 4:30 p.m.

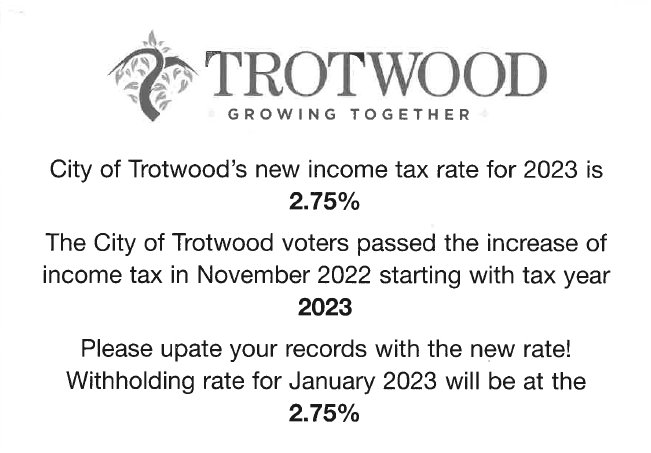

The City of Trotwood collects a 2.75% income tax from residents and businesses starting in 2023. The voters passed the new rate in November 2022 starting for tax year 2023. Please update your records for the new rate change. Income tax return filings are required of:

- All residents (regardless of income)

- Businesses (including nonresident businesses / self-employed individuals who work in Trotwood)

- Owners of rental property

- Any other person required to file and pay the municipal tax as determined by the Income Tax Ordinance (see below)

The due date for individuals and for calendar year net profit business returns is April 15.

The City of Trotwood collects a 2.25% income tax from residents and businesses is for tax year 2022 and prior years. Income tax return filings are required of:

- All residents (regardless of income)

- Businesses (including nonresident businesses / self-employed individuals who work in Trotwood)

- Owners of rental property

- Any other person required to file and pay the municipal tax as determined by the Income Tax Ordinance (see below)

The due date for individuals and for calendar year net profit business returns is April 15.

Important Income Tax Updates

Application Taxpayers' Rights & Responsibilities

Income Tax Ordinances

Contact Us: